VA Home Loans: Simplifying the Home Acquiring Process for Armed Force Employee

VA Home Loans: Simplifying the Home Acquiring Process for Armed Force Employee

Blog Article

Understanding How Home Loans Can Promote Your Journey In The Direction Of Homeownership and Financial Security

Browsing the intricacies of home financings is necessary for anyone striving to achieve homeownership and develop economic stability. Numerous kinds of finances, such as FHA, VA, and USDA, use unique advantages customized to various conditions, while recognizing rates of interest and the application procedure can considerably affect the total price of a home. Handling your home mortgage properly can lead to long-lasting financial benefits that prolong beyond plain ownership. As we take into consideration these important components, it becomes clear that the path to homeownership is not simply concerning securing a car loan-- it has to do with making informed selections that can shape your economic future.

Types of Home Loans

Standard lendings are a popular option, typically needing a higher credit history and a down repayment of 5% to 20%. These lendings are not guaranteed by the government, which can cause stricter credentials requirements. FHA car loans, backed by the Federal Real Estate Administration, are developed for novice buyers and those with lower credit scores, enabling deposits as reduced as 3.5%.

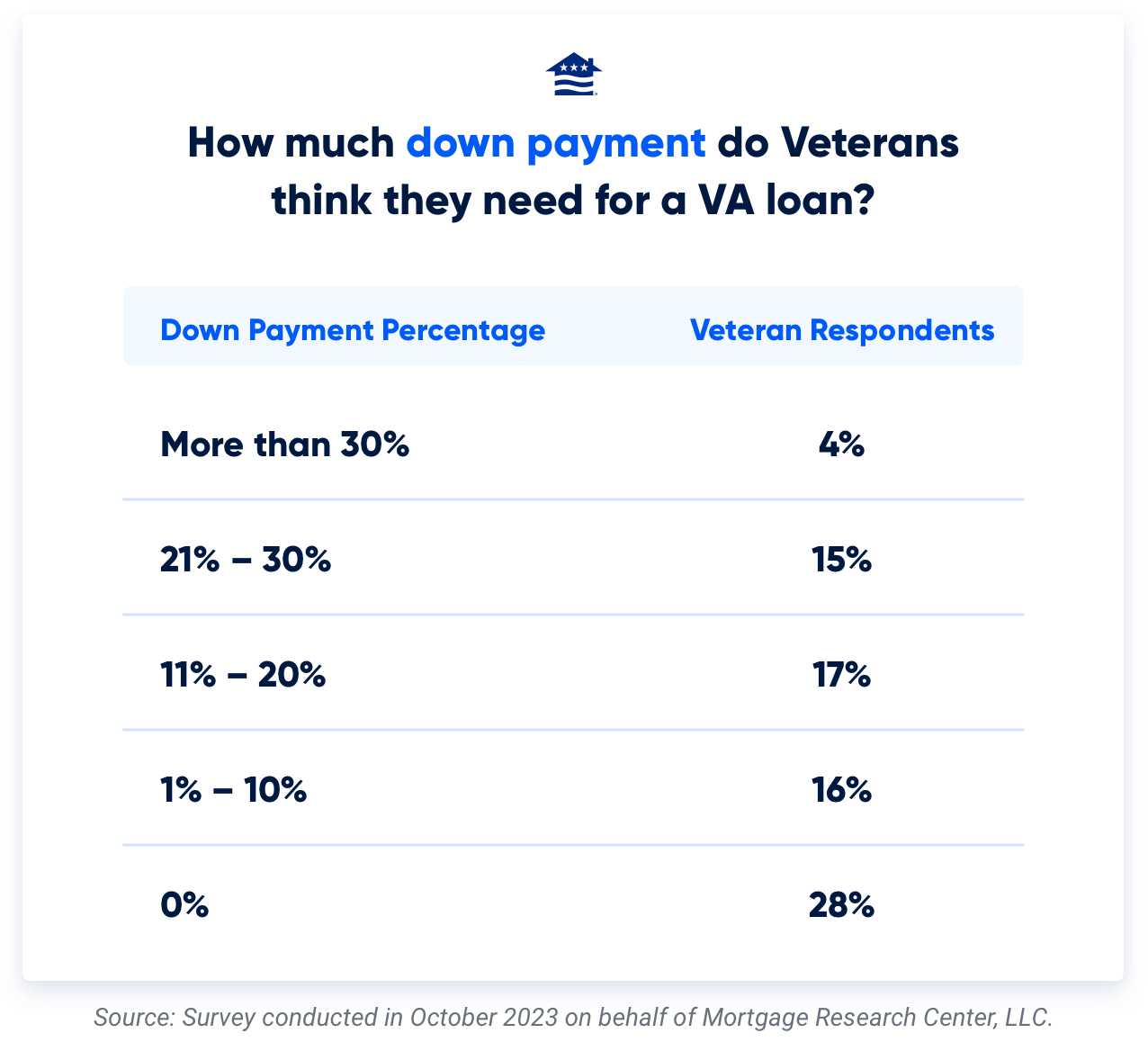

VA financings, offered to professionals and active-duty armed forces workers, provide beneficial terms such as no down payment and no private mortgage insurance policy (PMI) USDA finances provide to country buyers, advertising homeownership in less largely booming locations with low-to-moderate income degrees, additionally requiring no down settlement.

Lastly, adjustable-rate home mortgages (ARMs) provide lower initial rates that readjust over time based upon market problems, while fixed-rate home mortgages provide steady monthly payments. Recognizing these choices enables potential homeowners to make educated decisions, aligning their financial goals with the most ideal loan type.

Understanding Rates Of Interest

Rate of interest play a critical duty in the mortgage process, substantially impacting the overall cost of borrowing. They are basically the price of borrowing money, shared as a percent of the financing amount. A lower rate of interest rate can result in substantial savings over the life of the funding, while a higher rate can result in boosted monthly settlements and overall rate of interest paid.

Passion rates rise and fall based on different factors, including financial problems, rising cost of living rates, and the financial policies of central financial institutions. A set price continues to be continuous throughout the financing term, supplying predictability in regular monthly settlements.

Comprehending exactly how rates of interest work is critical for potential home owners, as they straight affect affordability and economic planning. It is suggested to contrast rates from various loan providers, as even a small difference can have a significant effect on the complete cost of the loan. By keeping abreast of market patterns, consumers can make enlightened choices that line up with their monetary objectives.

The Application Process

Navigating the mortgage application procedure can originally seem difficult, however understanding its key elements can simplify the trip. The primary step entails event required documents, including proof of revenue, income tax return, and a list of obligations and properties. Lenders need this info to examine your monetary stability and creditworthiness.

Next, you'll need to select a lending institution that lines up with your economic requirements. Study various home mortgage products and rate of interest, as these can significantly affect your regular monthly payments. When you pick a loan provider, you will certainly complete an official application, which may be done online or in individual.

Once your application is accepted, the lending institution will certainly provide a loan estimate, detailing the prices and terms connected with the home loan. This essential paper enables you to analyze your choices and make notified choices. Successfully navigating this application process lays a strong structure for your journey toward homeownership and monetary security.

Managing Your Mortgage

Managing your mortgage successfully is crucial for maintaining monetary health and wellness and making certain long-lasting homeownership success. A positive technique to home loan monitoring includes recognizing the regards to your lending, including rates of interest, repayment routines, and any prospective fees. Routinely assessing your mortgage declarations can help you remain notified concerning your staying balance and repayment background.

Producing a spending plan that accommodates your home loan repayments is important. Make sure that your regular monthly budget includes not only the principal and rate of interest but additionally home taxes, home owners insurance, and maintenance costs. This thorough sight will stop economic stress and unexpected costs.

Furthermore, consider making extra settlements in the direction of your principal when possible. This approach can considerably lower the total interest paid over the life of the lending and reduce the settlement top article duration. Refinancing is one more option worth checking out, particularly if rates of interest drop significantly. It can lead to lower regular monthly payments or a more beneficial lending term (VA Home Loans).

Lastly, keeping open communication with your loan provider can supply quality on options available must monetary problems develop. By proactively handling your mortgage, you can boost your economic stability and strengthen your course to homeownership.

Long-Term Financial Conveniences

Homeownership provides significant long-term financial benefits that expand beyond plain shelter. Among one of the most significant benefits is the possibility for residential or commercial property appreciation. Over time, actual estate generally appreciates in worth, permitting house owners to build equity. This equity functions as an economic asset that can be leveraged for future news investments or to fund major life occasions.

Furthermore, homeownership supplies tax obligation benefits, such as mortgage interest reductions and building tax deductions, which can considerably reduce a home owner's taxed earnings - VA Home Loans. These reductions can cause substantial financial savings, boosting total monetary stability

In addition, fixed-rate home loans secure house owners from increasing rental prices, ensuring predictable monthly payments. This security allows individuals to budget plan properly and prepare for future costs, facilitating long-lasting monetary objectives.

Homeownership additionally cultivates a sense of neighborhood and belonging, which can result in increased civic engagement and support networks, better adding to monetary health. Eventually, the financial advantages of homeownership, including equity development, tax obligation advantages, and cost stability, make it a foundation of lasting financial protection and wide range build-up for households and individuals alike.

Conclusion

To conclude, recognizing mortgage is essential for navigating the path to homeownership and accomplishing financial security. By exploring various loan options, comprehending interest prices, and have a peek at this website understanding the application process, potential customers furnish themselves with the understanding needed to make educated decisions. Furthermore, efficient home loan administration and recognition of long-lasting economic advantages add substantially to developing equity and fostering area engagement. Eventually, educated choices in home funding cause boosted monetary safety and overall wellness.

Browsing the complexities of home loans is necessary for anyone striving to accomplish homeownership and develop monetary security. As we consider these essential aspects, it comes to be clear that the course to homeownership is not simply concerning safeguarding a car loan-- it's regarding making notified choices that can shape your financial future.

Recognizing just how interest prices work is vital for possible house owners, as they straight affect affordability and economic preparation.Handling your mortgage properly is necessary for maintaining financial health and wellness and making sure lasting homeownership success.In conclusion, comprehending home finances is important for navigating the course to homeownership and achieving monetary security.

Report this page